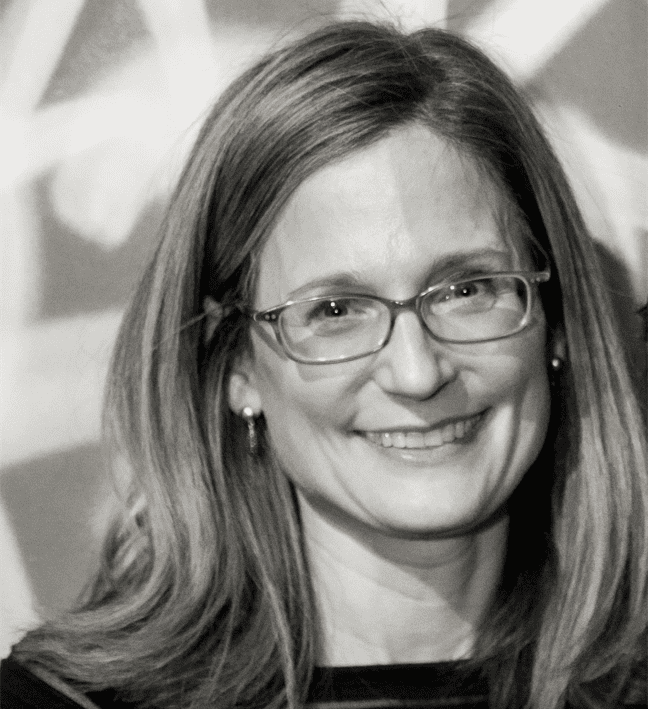

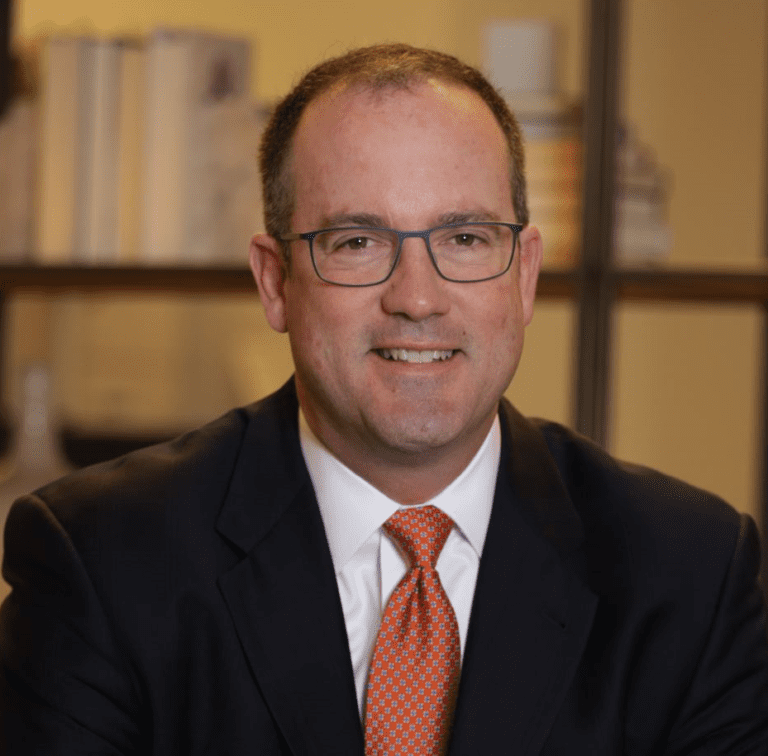

ELIZABETH SHEA FRIES is the managing partner of Sidley’s Boston office, global leader of the Investment Funds practice, and a member of the firm’s Executive Committee. Liz provides clients strategic advice on a broad range of transactions, business and investment structures and regulatory matters. She has particular experience in creating and structuring asset management and other financial businesses, financial services mergers and acquisitions, innovative investment services and products, alternative investments, fiduciary issues and compliance matters.

Liz maintains a diverse practice covering all aspects of the asset management business, working with investment managers, funds, broker-dealers, banks and other firms across various sectors. Liz has guided numerous financial services firms through mergers, acquisitions and other complex transactions. She works closely with management to structure and effect transactions, including leveraged management buyouts, stock and asset acquisitions, mergers, outsourcing arrangements and private and public offerings of securities.

Liz has substantial experience regarding the organization and structure of numerous business and investment entities and assists clients in creating and implementing investment products and service arrangements. She is experienced in the public and private offering of interests in open-end and closed-end management investment companies and other collective investment vehicles or pools, such as offshore investment funds, investment limited partnerships, private Real Estate Investment Trusts (REITs), group trusts, common and collective funds, and business or other investment trusts. Liz also counsels investment advisers, investment companies, banks, insurance companies, brokers and other providers of financial services regarding complex compliance issues resulting from the operation and integration of a variety of investment businesses. Working with multiple areas of law, including securities laws, Employee Retirement Income Security Act (ERISA), banking laws, commodities laws, tax laws and others, she is experienced in analyzing complex issues and managing multi-faceted challenges toward practical resolutions.

Liz has been recognized as a leading lawyer for Hedge Funds in Chambers Global: The World’s Leading Lawyers for Business (2016, 2019–2023), Chambers USA: America’s Leading Lawyers for Business (2017–2022), and as a 2019 Lawyer of the Year Private Funds/Hedge Funds Law (Boston). She has also been selected for inclusion in U.S. News — Best Lawyers, The Legal 500 U.S., The International Who’s Who of Private Fund Lawyers and the Women in Business Law Expert Guide, among others. The Legal 500 U.S. specifically identifies her “deep experience” and “innovative approach.” Chambers Global 2015 noted that she is “excellent in her command of the subject area, while also being responsive, thoughtful and commercial in her thinking.”