MFA Network 2023 - Agenda

Explore sections

- Day 1 - January 31

- Day 2 - February 1

8:15am - 9:00am

9:00am - 9:15am

Welcome Remarks

Speaker:

Natalie is responsible for overseeing Anchorage’s day to day operations. Having previously served as Anchorage’s Chief Operating Officer, Natalie was responsible for creating and developing a well-respected and industry-leading credit and distressed infrastructure organization. She is the Chair of the ACG Management Committee, a member of the Operational Risk & Security Committee, the Best Execution Committee, the Valuation Committee, the Allocation Committee and the Proxy Voting Committee. She is also a voting member of Anchorage’s Legacy Funds Investment Committee. Natalie joined Anchorage in February 2007. Natalie currently serves as the Chair of the Managed Funds Association’s Board of Directors. Prior to joining Anchorage, Natalie was the Chief Operating Officer of Arden Asset Management. Previously, Natalie served in various senior management positions with Deutsche Bank/Bankers Trust, where she worked for 17 years. During this period, Natalie served as Chief Operating Officer for Deutsche Bank’s Absolute Return Strategies Group as well as Deutsche Bank’s U.S. Institutional Asset Management business. Natalie has a total of 35 years of experience in the financial services industry and received an M.B.A from New York University’s Stern School of Business and a B.S. from Elizabethtown College.

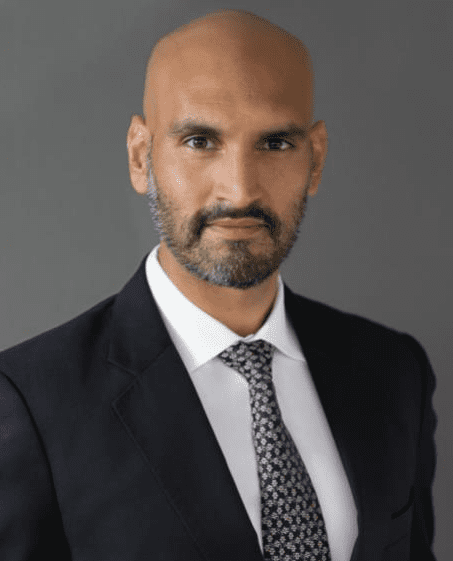

Bryan Corbett is MFA’s President and CEO. He is a veteran of Washington and Wall Street. For the past 12 years, he was a senior executive at The Carlyle Group, most recently as Managing Director in the Corporate Private Equity segment and Head of the firm’s OneCarlyle Global Investment Resources Group. In this role, Mr. Corbett and his team provided strategic and operational support to investment teams and portfolio companies across segments.

For the first half of his Carlyle tenure, Mr. Corbett managed U.S. government and regulatory issues affecting Carlyle, its investments and the industry. In this role, he developed legislative and regulatory strategies relating to all of Carlyle’s business segments, including private equity, credit and real estate. In addition to serving on the boards of several Carlyle portfolio companies, Mr. Corbett started the firm’s global corporate citizenship program focused on responsible investing, published Carlyle’s inaugural corporate citizenship report, and started the firm’s initiative to recruit and place diverse individuals on portfolio company boards in the U.S.

Prior to joining Carlyle, Mr. Corbett served in the George W. Bush Administration as a Special Assistant to the President for Economic Policy and as the Senior Advisor to Deputy Secretary Robert Kimmitt at the Treasury Department. He also served as Majority Counsel on the Senate Banking Committee.

Mr. Corbett earned his JD from George Washington University Law School, where he was editor-in-chief of the George Washington Law Review, and earned his BA from University of Notre Dame.

9:15am - 9:25am

The Macro Odyssey: HFRI 500 Performance Update & Outlook 2023

Speaker:

Kenneth J. Heinz, CFA is the President of Hedge Fund Research, Inc. (HFR) and is a leading authority on the global hedge fund industry. Mr. Heinz manages HFR’s industry leading hedge fund index business, including the HFRI, HFRX, HFRL and HFRU Indices. Mr. Heinz has provided specialized consulting services to the industry’s most significant institutional investors globally and has worked directly with thousands of managers, including many of the industry’s most influential firms. He has also contributed authoritative research and commentary to some of the industry’s best-known conferences and organizations, having provided keynote presentations at or for the following: Cayman Islands Alternative Investment Summit, GAIM (Monaco), the SwissFunds Association (SFA), University of Chicago Booth School of Business, Alternative Investment Council of Switzerland (AIC), University of Chicago Center for Research and Security Prices (CRSP), Skybridge Conference (Las Vegas), Money Talks (China) and various CFA Society Events. He is also a highly sought-after source of expert commentary for leading media outlets Including the Fox Business News, Wall Street Journal (WSJ), Financial Times (FT), Dow Jones Newswires, CNBC (U.S., European, Asian), New York Times, London Times, the Guardian, CNN, Fortune, Time, Pensions & Investments, Barron’s, the Nikkei, Bloomberg and many more.

Mr. Heinz has a Master of Business Administration from University of Chicago Booth School of Business with a concentration in Econometrics and Statistics and is a Charter Financial Analyst (CFA). Mr. Heinz holds a Bachelor of Science from the University of Illinois, with a concentration in Finance, Business Finance, Investments and Financial Institutions. Mr. Heinz also has experience as a trading member of Chicago Mercantile Exchange, Chicago Board of Trade and Chicago Board of Options Exchange.

9:25am - 9:35am

Presentation: Year-Ahead Capital Flows and Investor Outlook

Speaker:

Sam Monfared joined Preqin in November 2020 and is the newest member of the Insights team. Prior to joining Preqin, Sam served as Chief Risk Officer of Anchor Pacific Investment Management (“APIMC”), where he was responsible for portfolio strategy development, portfolio construction, risk analytics and research design. Prior to working at APIMC, he held various research positions and analyzed public and private markets. Sam holds a PhD in Finance, and is a CFA and a CAIA charter holder

9:35am - 10:10am

2023 Economic Outlook and Fed Policy Analysis

Speakers

Jan is head of the Global Investment Research Division and the firm’s chief economist. He is a member of the Firmwide Client and Business Standards Committee. Previously, he was head of Global Economics and Markets Research. Jan joined Goldman Sachs in the Frankfurt office in 1997 and transferred to New York in 1999. He was named managing director in 2004 and partner in 2008. Prior to joining Goldman Sachs, Jan was a research officer at the London School of Economics. Jan is the No. 1 ranked global economist in the annual Institutional Investor Global Fixed-Income Research Team, a position he has held in the global or US category for the past decade. Jan is a member of the economic advisory panels of the Federal Reserve Bank of Chicago and the Congressional Budget Office. Jan earned a D.Phil. in Economics from Oxford University, as well as degrees from the University of Wisconsin-Madison and the Kiel Institute for the World Economy

Atul Lele joined Bridgewater in 2018, and is a Portfolio Strategist. As a senior member of the research group, Atul works closely with our Co-CIOs, and also partners with Bridgewater’s clients to develop investment strategies that meet their objectives and to provide insight into the research group’s thinking on global markets and economic conditions. Prior to joining Bridgewater, Atul spent five years as the Chief Investment Officer of Deltec International Group, where he was responsible for their investment management and advisory platform, focusing on the investment strategy, portfolio management and analytical processes behind the strategic and tactical global macro funds, and authoring the firm’s global macro research publications. Prior to that, Atul spent five years as the Head of Strategy, Economics and Quantitative Research for Credit Suisse Australia, where he was top ranked by clients and external surveys. Before that, he spent eight years as a Portfolio Manager and Partner at White Funds Management, a multi-asset class fund manager. Atul has regularly appeared in the financial media and in investment-related books. He is also a CFA charterholder, and holds a Bachelor of Commerce in Accounting and Finance from the University of New South Wales.

Nathan Sheets recently joined Citigroup as Global Chief Economist. In that role, he helps lead the Firm’s team of economists around the world. His own research focuses on global themes, with a particular emphasis on the position of the United States in the world economy.

Previously, Mr. Sheets worked at the Federal Reserve Board for 18 years in a variety of positions. From September 2007 to August 2011, he served as Director of the Board’s Division of International Finance and one of three Economists to the Federal Open Market Committee (FOMC). He advised the Committee on macroeconomic and financial developments in foreign economies, as well as on the outlook for U.S. trade, the dollar, and global commodity prices. He also played a key role in the design and implementation of the Fed’s swap line program with other central banks that was put in place during the financial crisis. Mr. Sheets represented the Federal Reserve at many international meetings—including of the G-20, G-7, and OECD—and was a member of the Committee on the Global Financial System sponsored by the Bank for International Settlements. From 2006-07, while on leave from the Board, he served as a Senior Advisor to the U.S. Executive Director at the International Monetary Fund.

Mr. Sheets has published research in the Journal of Money, Credit, and Banking, the Journal of International Money and Finance, the Journal of International Economics and the Review of International Economics. He received his B.A. in economics in 1989 from Brigham Young University. As a recipient of the National Science Foundation Fellowship, Mr. Sheets completed his Ph.D. studies at the Massachusetts Institute of Technology in 1993.

David Zervos is currently Chief Market Strategist for Jefferies LLC and Head of the Global Macro Division of Leucadia Asset Management, LLC (“LAM”). David joined Jefferies in 2010 after spending 2009 as a visiting advisor at the Board of Governors of the Federal Reserve System in Washington, D.C. Prior to visiting the Federal Reserve, he held a variety of research, sales and trading positions in the private sector, most recently managing global macro portfolios for Brevan Howard and UBS O’Connor. He began his career as an economist at the Federal Reserve Board in the early 1990’s. He received a B.Sc. from Washington University, and an M.A. and Ph.D. in economics from the University of Rochester.

Moderated by:

Stephen King is an economist and author.

Stephen’s fourth book, We Need to Talk About Inflation, will be published by Yale in April 2023. Described by Mervyn King, former Governor of the Bank of England, as “timely, well-researched and very well-written”, the book offers “fourteen urgent lessons from the last 2,000 years”.

His last book, Grave New World: The End of Globalization, the Return of History (Yale) was published in May 2017 to considerable critical claim: long-listed for the FT-McKinsey Business Book of the Year, it was later picked as a ‘book of the year’ by the Financial Times. It has since been translated into multiple languages.

Since 2018, Stephen has been a regular columnist for the London Evening Standard. He has also written for, among others, the Financial Times, the Times, the Independent and the New York Times. Between 2015 and the 2017 General Election, he was a Special Adviser to the House of Commons Treasury Committee.

Stephen is an accomplished public speaker and has presented at conferences all over the world.

As part of a portfolio of interests and following 17 years as HSBC’s Chief Global Economist, Stephen was appointed HSBC’s Senior Economic Adviser in 2015.

Stephen’s career began at H.M.Treasury, where he was an economic adviser within the civil service.

Stephen studied at New College, Oxford. In his spare time, he plays the piano.

10:10am - 10:35am

Fireside Keynote Chat with Paul Singer

Keynote:

Paul E. Singer is the Founder, President, Co-Chief Executive Officer, and Co-Chief Investment Officer of Elliott Investment Management. Launched in 1977 with $1 million of capital, total assets under management for the Elliott funds have grown to approximately $55.7 billion as of June 30, 2022. Elliott is a Florida–based trading firm with affiliated offices elsewhere.

Mr. Singer is co-founder of Start-Up Nation Central, an Israel-based non-profit organization. He is also chairman of The Manhattan Institute for Policy Research.

Mr. Singer holds a B.S. in Psychology from the University of Rochester and a J.D. from Harvard Law School.

Moderated By:

Marcus Frampton, CFA, CAIA, FRM serves as the Chief Investment Officer of the Alaska Permanent Fund Corporation, where he manages a team of 25 investment professionals and is responsible for leading the firm’s investment activities. Mr. Frampton has been with APFC since 2012 and served as the Director of Investments, Real Assets & Absolute Return before his promotion to CIO in 2018.

Prior to joining APFC, Marcus held diverse roles ranging from investment banking with Lehman Brothers, private equity investing with PCG Capital Partners, and as an executive with LPL Financial, a private equity backed portfolio company.

Mr. Frampton holds a BA in Business-Economics with a minor in Accounting from UCLA. In addition to serving on the Board of Directors of Managed Funds Association, Marcus is also a Director of Scientific Industries, Inc. (OTC: SCND), a leading manufacturer of laboratory equipment and developer of intellectual property and products around bioprocessing; Nyrada, Inc., a privately-held drug development company; and Twin Creeks Timber, LLC, a privately-held owner/operator of institutional quality timberland assets.

10:35am - 11:00am

Keynote Fireside Chat with Sander Gerber

Keynote:

Sander Gerber is Chief Executive Officer and Chief Investment Officer of Hudson Bay Capital, a multi-strategy hedge fund manager investing globally. Mr. Gerber has more than 30 years of investing experience in multiple securities classes and derivatives across a broad range of strategies. Hudson Bay Capital has delivered high quality risk adjusted returns for investors throughout multiple market cycles.

In 2008, Mr. Gerber developed the Gerber Statistic, which measures the co-movement of financial assets, enabling early detection of concentration risks and insufficient diversification within an absolute return portfolio. Later, after many years in collaboration with Harry Markowitz, the Nobel Prize-winning economist and father of Modern Portfolio Theory (MPT), research was completed to optimize the modern portfolio construct by replacing historical covariance with the Gerber Statistic. This groundbreaking paper was published in the Journal of Portfolio Management of February 2022.

Mr. Gerber is also the chief designer of his firm’s proprietary Deal Code framework, a scalable, repeatable portfolio management system that provides granular control seeking to minimize loss, maximize return, and optimize the judgment skills of Hudson Bay Capital’s investment professionals.

Mr. Gerber began his investment career in 1991, as a member of the American Stock Exchange working as an equity options market maker. In 1997, he founded Gerber Asset Management LLC (“GAM”) to develop and engage in proprietary investment strategies, many of which are utilized by Hudson Bay Capital today. In late 2005, Mr. Gerber and Yoav Roth co-founded Hudson Bay Capital, which absorbed GAM’s business and 15 employees.

Prior to becoming a member of the American Stock Exchange, Mr. Gerber was an Associate Consultant at Bain & Company, a leading strategic management consulting firm where he assisted the senior management of multinational corporations to identify and implement corporate growth opportunities.

Mr. Gerber is a member of the Council on Foreign Relations and the Economic Club of New York. He is a fellow and board member of the Jerusalem Center for Public Affairs, an independent research institute specializing in public diplomacy and foreign policy. Mr. Gerber serves as a member of the United States Agency for International Development’s Partnership for Peace Fund Advisory Board. The Board provides information and advice to USAID, and other U.S. Government agencies to promote economic cooperation, people-to-people peacebuilding programs, dialogue, and reconciliation between Israelis and Palestinians. Mr. Gerber was previously a member of the Director of National Intelligence’s Senior Advisory Group (SAG). SAG provides the Director of National Intelligence with an informed, external perspective regarding policy, industry best practices, technology breakthroughs, and best-in-class solutions relevant to current intelligence issues.

Mr. Gerber graduated cum laude from the University of Pennsylvania, with a BSE in Finance from Wharton and a BA in Humanistic Philosophy from the College of Arts and Sciences.

Moderated By:

Mr. Josephiac joined Meketa Investment Group in 2021 and has formally been in the investment industry since 2008. A Senior Vice President of the firm, Mr. Josephiac serves as a Research Consultant in Meketa’s Marketable Alternatives practice covering multiple types of strategies such as beta-neutral, long volatility and uncorrelated/niche opportunities. His work includes investment due diligence, portfolio construction, asset allocation and oversight of client portfolios.

Prior to joining the firm, he was responsible for managing United (Raytheon) Technologies’ portable alpha/hedge fund program as well as covering global equities, risk parity and multi-asset/strategic partnership portfolios. Prior to that, he held multiple roles at The Boston Company Asset Management as part of the business development and client service teams.

Mr. Josephiac graduated magna cum laude from Bentley University with a Bachelor of Science in Finance and minors in Economics and International Studies. He is a CFA and CAIA charterholder as well as a member of the CFA Hartford Society. He is a member of the Bentley University endowment investment committee and a member of the Ellington Community Scholarship Association.

11:00am - 11:25am

11:25am - 12:00pm

Commodities are Back: Pitfalls and Advantages of Trading

Speakers:

Christopher Burton, CFA, FRM, is a Managing Director within Credit Suisse Asset Management, based in New York. Mr. Burton serves as the Global Head of Commodities within Asset Management. He also currently acts as Senior Portfolio Manager and Trader for the Commodities Team. In this role, Mr. Burton is responsible for analyzing and implementing the team’s hedging strategies, indexing strategies, and excess return strategies. Prior to joining Credit Suisse in 2005, Mr. Burton served as an Analyst and Derivatives Strategist with Putnam Investments, where he developed the team’s analytical tools and managed their options-based yield enhancement strategies, as well as exposure management strategies. Mr. Burton earned a B.S. in Economics with concentrations in Finance and Accounting from the University of Pennsylvania’s Wharton School of Business. Additionally, Mr. Burton is a CFA Charterholder and has achieved Financial Risk Manager® Certification through the Global Association of Risk Professionals (GARP).

Simon is Co-Chief Investment Officer, with overall responsibility for investment and research. He is also a member of Winton’s executive management and investment committees.

Simon joined Winton in 2008 as a researcher focused on designing commodity trading systems. In subsequent years he led research into new macro and equities trading strategies and portfolio construction methods, before taking overall responsibility for futures strategies in 2016.

Simon has a first-class honours degree in physics and philosophy from Oxford University, and a PhD in physics from Columbia University, with a thesis on string theory and cosmology.

Mr. Sharenow is a managing director and portfolio manager in the Newport Beach office, focusing on commodities, real assets, and inflation solutions. He leads PIMCO’s commodity portfolio management group. He also co-manages PIMCO’s Energy and Tactical Credit Opportunities strategy. Prior to joining PIMCO in 2011, he was an energy trader at Hess Energy Trading, Goldman Sachs, and DE Shaw. He was previously senior energy economist at Goldman Sachs. His co-authored article, “Beating Benchmarks,” won the Second Annual Bernstein Fabozzi/Jacobs Levy Award for Outstanding Article after it was published in the Journal of Portfolio Management. He has 23 years of investment and financial services experience and holds bachelor’s degrees in mathematical methods in the social sciences and in economics from Northwestern University. He is a member of the Council on Foreign Relations.

Michael Soss, PhD is the Deputy Chief Investment Officer of Millburn Ridgefield Corporation, and serves as a member of Millburn’s Investment Committee. He joined the firm in 2022 and shares responsibility with Grant Smith, Chief Investment Officer, in the management of the firm’s Research & Development functions. Mr. Soss received an AB degree in Mathematics from Harvard University, and MSc and PhD degrees in Computer Science from McGill University in Montreal, Canada. Mr. Soss has substantial experience in the asset management industry including, most recently, more than 5 years at Point72 Asset Management, where he headed the firm’s Fusion group, a quantitative trading group focused on internal alpha capture. Experience prior to Point72 includes senior roles at J.P.Morgan, SECOR Asset Management and Goldman Sachs.

Steven Wilson is Director in the Public Markets group at the Teacher Retirement System of Texas, a $200 billion pension system serving 1.8 million active and retired educators and their families. Mr. Wilson is responsible for the $10B Stable Value Hedge Fund Portfolio, which includes allocations to Equity Market Neutral, Macro, Managed Futures, Platform, Volatility, and Reinsurance Hedge Funds. He is also responsible for the $7B World Equity Portfolio, which includes Beta Sensitive strategies benchmarked to global equity indices.

Prior to joining TRS, Mr. Wilson was an Investment Director at Ameriprise Private Wealth Advisors, where he oversaw fund selection for $250 million of client assets.

Mr. Wilson received an MBA from the Rice University Jones School of Business in 2012, is a graduate of the University of Texas at Austin McCombs School of Business, and holds the CAIA designation.

Moderated By:

Jackie Rosner joined the firm in 2013 and is a Managing Director and a member of the Portfolio Management team, with a specific focus on global macro, relative value, managed futures, and quantitative strategies. Prior to joining, Mr. Rosner was a Managing Director, head of global macro and systematic trading strategies, and a member of the executive committee at Union Bancaire Privee Asset Management in New York. Prior to UBP, Mr. Rosner was a proprietary trader at BNP Paribas in New York. Mr. Rosner has also been a portfolio manager at both Archeus Capital Management and Millennium Partners, and was a founding member of a proprietary trading desk in the fixed income department of Chase Manhattan Bank/J.P. Morgan. Mr. Rosner began his career at Salomon Brothers (Citibank) where he held various positions of increasing responsibility primarily focused on quant, trading, and fixed income strategies. Mr. Rosner is on the advisory board for the MIT Sloan Department of Finance, volunteers as a master’s thesis supervisor at the Department of Mathematics at NYU Courant, and has guest lectured at Columbia University’s Department of Financial Engineering. Mr. Rosner holds a B.S. in Economics, a B.S. in Management Science, and an M.Sc in Management from the Sloan School of Management at Massachusetts Institute of Technology. He also holds an M.Sc in Mathematical Finance from New York University and completed the following Charters: CFA, CAIA, CMT, and FRM.

12:00pm - 12:30pm

Redefining Private Credit: The Shift to Bigger Allocations? Bigger Risk?

Speakers:

Anne-Marie Fink serves as the State of Wisconsin Investment Board’s Chief Investment Officer for Private Markets and Funds Alpha. At SWIB since 2020, she is responsible for overseeing more than $70 billion in assets in private equity, real estate, hedge funds, externally managed accounts, private debt, and venture capital portfolios, and a team of 38 professionals.

Anne-Marie has more than two decades of investment management experience. She served as the chief investment officer for the Employees’ Retirement System of Rhode Island and for a large family office. Anne-Marie started her investment career at JP Morgan, where she spent more than 16 years as an equity and hedge fund analyst. Before SWIB, she was at State Street Global Advisors as the portfolio strategist for alternative investments.

Anne-Marie earned a Bachelor of Arts degree from Yale University and an MBA from Columbia Business School. She is also the author of The Money Makers: How Extraordinary Managers Win in a World Turned Upside Down, which draws on investors’ experience to identify best practices in business management across companies and industries.

Dr. Ulrike Hoffmann-Burchardi is a Senior Portfolio Manager and Managing Director at Tudor Investment Corporation, overseeing a global equity portfolio inside Tudor’s flagship client strategy. Focusing on the opportunities of digital disruption, Ulrike invests into companies with a long-term investment horizon, making substantial use of new data sources to understand market trends and technology adoption.

She was recognized in 2022 as one of “100 Most Influential Women in US Finance” by Barron’s magazine and in 2019 as one of ”50 Leading Women in Hedge Funds” by the Hedge Fund Journal in association with Ernst & Young. Prior to managing her current fundamental equity portfolio for Tudor’s flagship fund, Ulrike was instrumental in building the global quantitative equity investment strategies for Tudor in London and New York from 1999 to 2009.

Ulrike serves on the board of 100 Women in Finance, a global 15,000 member non-for-profit organization to empower women in the finance and alternative investment industries. An advocate for STEM education in grades K-12, she serves as a member of the advisory board of NYC FIRST, a global youth-serving robotics community. Further, she joined the advisory board of Portfolios with Purpose, a non-for-profit organization that fosters investment literacy among pre-career diverse youth. She is a member of the Economic Club of New York as well as of Atlantikbruecke.

She holds a PhD in Finance from the London School of Economics and Political Science (2000), and graduated first in her class with a Master degree in Finance from the University of St. Gallen in Switzerland (1995).

Ulrike is a Fellow of the 2021 class of the Finance Leaders Fellowship and a member of the Aspen Global Leadership Network.

Mr. Mulé is the CEO of Silver Point Capital and Portfolio Manager of Silver Point’s funds, having built and run the Firm since inception in 2002. Silver Point Capital is a global credit investor managing approximately $21bn in investible assets. Prior to founding Silver Point, Mr. Mulé worked for more than 16 years at Goldman Sachs. Mr. Mulé, together with his co-founding partner Mr. O’Shea, led Goldman’s special situations businesses, including establishing a proprietary middle market direct lending business for the firm. He headed or co-headed Goldman’s Special Situations Investing Business from 1999 to 2001, and co-founded and headed or co-headed the Asian Special Situations Investing Business (“ASSG”) and associated funds, including the Goldman Sachs Special Opportunities (Asia) Fund, from 1998 to 2001. In 1996, Mr. Mulé and Mr. O’Shea established a proprietary middle market lending business for Goldman. Mr. Mulé was elected general partner in 1994. Before joining Goldman’s special situations efforts in 1995, Mr. Mulé worked for Jon Corzine and Henry Paulson in 1994 and Robert E. Rubin and Stephen Friedman from 1991 to 1994 in the Office of the Chairman. In this role, he assisted the chairmen on strategy and its implementation, as well as reengineering, setting up control and compliance infrastructure and cost cutting. Prior to that, Mr. Mulé was an investment banker in the Mergers and Acquisitions Department from 1984 to 1991, specializing in a number of areas, including telecommunications, consumer products and forest products. He was a member of Goldman’s Senior Traders Committee. Mr. Mulé graduated magna cum laude from the University of Pennsylvania’s Wharton School, contemporaneously receiving both his M.B.A. and B.S. degrees at the age of 21.

Moderator:

Jillien Flores serves as Executive Vice President, Managing Director, Head of Global Government Affairs at MFA.

Flores joined MFA after six years at Vanguard, one of the world’s leading asset managers. There, she advocated before Washington policymakers on a range of issues related to US capital markets, tax, and retirement policy. Leveraging policy depth, strategy, and relationships, Flores achieved policy outcomes beneficial to Vanguard’s clients on issues including equity market structure, ESG and corporate governance, and systemic risk.

Throughout her career, Flores has sought opportunities to advance Diversity, Equity, and Inclusion within the financial services sector, serving in leadership roles of related efforts at Vanguard.

Prior to joining Vanguard, Flores was Director of Government Relations at Porterfield, Lowenthal, Fettig & Sears, where she represented clients before Congress and the federal financial regulators in the asset management, insurance, securities, and biotechnology sectors. She was involved in the legislative and rule-writing process for several financial services laws and regulations, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Jumpstart Our Business Startups Act.

Flores earned a B.A. from the George Washington University in Washington, DC.

12:30pm - 1:15pm

1:15pm - 1:45pm

The Manager and Investor Perspective on ESG: Climate Tech

Speakers:

Allen manages the New York office of the Hedge Fund Research Group and brings over 20 years of alternative investment experience. He is also the asset group head for ESG leading in policy design, investment manager rating implementation and consulting advice to firms requiring ESG solutions.

Before joining Aon Hewitt in 2014, he was Chief Investment Officer at Altegris Advisors where he managed the research group and was Co-Portfolio Manager of the firm’s alternative funds. Allen was previously a Managing Director at Bank of America where he built and directed the hedge fund portfolio investment team and additionally oversaw numerous hedge fund products across diverse strategies. He has significant experience in the alternative investment industry, particularly in the areas of ESG, investment research and portfolio management across multiple investment strategies.

Allen earned his MBA from the University of Michigan and BA in Finance from the University of Maryland. As a volunteer, Allen is an Investment Committee member for Rady Children’s Hospital in San Diego, CA.

Prior to his current role, he was part of the GAM Systematic research team where his focus was on the development and enhancement of its systematic investment portfolios. Chris has been heavily involved in the research and review of all aspects of the Core Macro programme since its inception in 2013. His particular research interests include working with novel or alternative data sources as well as applying systematic trading styles to new and unconventional markets. Chris was previously part of the Machine Intelligence Laboratory at Cambridge University, where he obtained MPhil and PhD degrees. He also holds a BSc in Computer Science from Royal Holloway, University of London.

Mr. Withrow is a principal for AB CarVal, responsible for leading high-yield debt trading. Prior to joining AB CarVal in 2015, he most recently served as senior managing director and senior portfolio manager for Macquarie Credit Nexus Fund Limited. While at Macquarie, he managed a long/short high-yield trading book focused on relative value trading opportunities and capital structure investments as well as leveraged loans. Mr. Withrow received his M.B.A. from the Fuqua School of Business at Duke University. He received his M.S. in bioengineering and B.S. in mechanical engineering from the University of Pittsburgh.

Moderated by:

Osei Van Horne, Co-Global Head and Managing Partner of J.P. Morgan Sustainable Growth Equity within J.P. Morgan Private Capital, a division of J.P. Morgan Global Alternatives in J.P. Morgan Asset Management.

Osei joined J.P. Morgan Private Capital in 2021. Alongside Tanya Barnes, Osei co-leads the SGE platform, which leverages the global scale, sustainability expertise and data intelligence of J.P. Morgan to invest in companies that are leading the transition to a sustainable future. SGE will initially seek to invest in private growth companies that produce measurable, science-based and commercially-driven positive sustainability outcomes. He has over 20 years of principal investing and corporate finance experience.

Prior to joining SGE, Osei was a Managing Director and Co-founder of the technology growth equity division of Wells Fargo Strategic Capital. At Wells Fargo, Osei invested in opportunities across series B through pre-IPO stages, overseeing a pool of sustainable technology investments. Previously, Osei was an investor in the Merchant Banking Division of Goldman Sachs where he focused on executing equity and mezzanine debt investment strategies across sustainable investment opportunities led by underrepresented entrepreneurs. Over his career, Osei has led or participated in a diverse range of investments across various stage, geography and market cycles including Arcadia Power, Flexport, Notarize, Sitetracker, and MCCI Group, among many others.

Osei is an Adjunct Professor at Columbia University Graduate School of Business where he teaches Foundations of Private Equity. Previously, he was an Adjunct Professor at New York University where he taught M&A and venture capital. Additionally, Osei has published research in the Journal of Private Equity and has contributed to institutional equity research addressing sustainable investment strategies in U.S. public equities.

Moreover, Osei serves as an advisory board member of the Global Industrial and Sustainability Council, a trade organization initiative created to advancesustainable practices among corporate venture capital funds. He also serves as an advisory board member to theVenture Fund, a non-profit organization that provides financial literacy programing and micro-financing to women-led small businesses. Lastly, he is a mentor at All Raise, a non-profit organization dedicated to supporting women and non-binary investors and entrepreneurs.

Osei received a B.S. in biology from Howard University. He resides in San Francisco Bay Area, California, with his wife and two daughters.

1:45pm - 2:10pm

The Manager and Investor Perspective on Distressed Investing: A Look Ahead

Keynote:

Anthony A. Yoseloff (Tony) is the Executive Managing Member of Davidson Kempner Capital Management LP, a global institutional investment management firm based in New York with over $33 billion in assets under management. Mr. Yoseloff joined the Firm in 1999. He is a member of the Board of Trustees of Princeton University, The New York Public Library and Leadership Enterprise for a Diverse America. He also serves on the investment committee of The New York Public Library and is a member of the Board of Directors of PRINCO, the investment manager of the Princeton University endowment.

Mr. Yoseloff received a J.D. from Columbia Law School and an M.B.A. from the Columbia Graduate School of Business Administration in 1999. He earned an A.B., cum laude, from the Woodrow Wilson School of Public and International Affairs at Princeton University in 1996.

Moderated By:

Carlos Rangel is vice president and chief investment officer for the W.K. Kellogg Foundation in Battle Creek, Michigan. In this role, he supports the foundation’s efforts to promote thriving children, working families, and equitable communities. During his more than a decade tenure at the foundation, Rangel has contributed his skill and innovative approaches to investments. Most recently, Rangel has been a co-executive sponsor for the Expanding Equity work for the Kellogg Foundation in partnership with the CEO’s office and the vice president for program strategy. Before joining the foundation, Rangel spent nine years at Managed Asset Portfolios researching public equities. From 2008 – 2010, he taught undergraduate finance classes as an adjunct instructor at Walsh College of Accountancy and Business Administration. Rangel earned his bachelor’s and master’s degrees in finance from the University of Michigan – Dearborn. He holds the following designations: Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), Chartered Alternative Investment Analyst (CAIA), and Certificate in Investment Performance Management (CIPM). He is on the boards of the Ewing Marion Kauffman Foundation and Family & Children Services.

2:10pm - 2:45pm

The Lost Art of Security Selection

Keynote:

Nancy Zimmerman is co-founder and managing partner of Bracebridge Capital, a leading Boston-based hedge fund manager with over $12 billion under management. Bracebridge is a pioneer in the field of absolute return investing and for over 25 years has focused on generating returns that are largely uncorrelated with broad moves in equities, currencies and rates.

Bracebridge manages private investment funds serving longstanding investors that include endowments, foundations, family offices and pensions. Nancy began her career at O’Connor & Associates and managed the interest rate option group on a worldwide basis for Goldman Sachs before founding Bracebridge.

Nancy graduated from Brown University in 1985, is a Fellow of the Corporation of Brown University, and chairs the Carney Institute for Brain Science Advisory Council. Through the Carney Institute and other institutions—including the Transformative Scholars Program in Neurology at Mass General Hospital and the Ragon Institute of MGH, MIT and Harvard – Nancy has led a series of initiatives that fund early-career investigators. During 2020 she helped fund and promote cutting-edge research on COVID-19.

She is a member of the Board of Directors of Social Finance US, a non-profit that tackles complex social challenges through innovative public private partnerships, such as Social Impact Bonds and Pay for Success financing. She also served for a decade on the scholar selection committee of the Institute for International Education’s Scholar Rescue Fund.

Moderated By:

2:45pm - 3:00pm

3:00pm - 3:35pm

2023 Global Macro Outlook: Navigating the World Economy

Speaker:

Kunjal Shah joined Lyxor Asset Management Inc. (“Lyxor Americas”) in August 2014 as the Global Head of Hedge Fund Research. He was appointed as Chief Investment Officer in May 2020. Mr. Shah is responsible for supervising the Portfolio Management and Hedge Fund Research teams, as well as developing advisory investment offerings and customized hedge fund solutions. Mr. Shah brings more than 20 years of experience in hedge fund manager selection, due diligence, and monitoring to his position.

Prior to joining the firm, Mr. Shah was employed by Arden Asset Management, where he was a Partner and Managing Director. Prior to that, he was a Director and Co-Head of Hedge Fund Credit Risk Management for the Americas at Deutsche Bank AG. He was also an integral member of the Hedge Fund Credit Risk Management team at Goldman Sachs & Co. in New York, where he led due diligence and monitoring of hedge funds.

Mr. Shah holds a B.A. in Economics from the University of Manchester, and an M.B.A. in Finance, Management and Strategy from the Kellogg School of Management at Northwestern University.

Mark is the leader of Wellington Management’s Global Macro team. Mark is a veteran macro risk-taker, the lead portfolio manager for the team’s investment portfolios, and the architect of Wellington’s US$10 billion multi-PM macro platform. As a manager of portfolio managers, he is responsible for internal manager selection, alpha and risk allocation to managers, and risk management across the team’s investment portfolios.

Mark received his BA from Colgate University. In addition, he holds the Chartered Financial Analyst and Chartered Market Technician designations.

Trent Webster is the Senior Investment Officer – Strategic Investments for the State Board of Administration of Florida, which manages approximately $204 billion for a variety of mandates in the state of Florida, including the $161 billion Florida Retirement System. He is responsible for $14 billion of investments in hedge funds, private debt, real assets, insurance, principle investments, and other alternative investments. Mr. Webster also was responsible for Private Equity for over a year. Prior to being appointed Senior Investment Officer, Mr. Webster ran the Special Situations fund for the State Board of Administration, a US-focused, catalyst-driven public equity fund, and was responsible for external manager oversight in the Domestic Equities department. Prior to coming to the State Board, Mr. Webster worked at Sprucegrove Investment Management and ScotiaMcLeod. He has a Master’s in Business Administration from the University of Toronto and a Bachelor of Commerce (Honours) from the University of Saskatchewan. Mr. Webster is a Chartered Financial Analyst.

Phil Yuhn is a Portfolio Manager, Man GLG.

Prior to joining Man GLG, he worked as a portfolio manager at American Century Investments. Prior to this, he was a senior portfolio manager at HSBC Asset Management from 2009-2015. Prior to HSBC, Phil worked three years in the Emerging Markets Debt Strategy group at Lehman Brothers from 2005-2008.

He has been working in the industry since 2005 and holds an MBA from the University of Chicago Booth School of Business. He received a BS and an MEng from Cornell University.www.man.com/glg

Moderated By:

JP Bruynes works with a range of professionals in the private investment space, focusing on the formation and operation of quantitative investment managers and funds. He actively participates in structuring, negotiating and documenting fund formation, seed capital and other transactions. He also advises hedge fund managers, investment advisers, commodity trading advisors (CTAs), commodity pool operators (CPOs) and third-party marketers with regulatory compliance, including responses to SEC, CFTC, NFA and exchange audits and investigations.

JP advises clients with respect to a broad variety of investing activity, including:

- Securities

- Commodities

- Futures contracts

- Options

- Swap transactions

- Cryptocurrencies.

JP brings over 25 years of experience representing leading quantitative fund managers in a practice that, in multiple industry surveys, is consistently hailed as a leader. With a team of over 100 lawyers, the practice is distinguished by the resources that it dedicates to representing quantitative fund managers, the high-profile nature of its engagements and the number of industry-leading managers that it represents.

JP is involved in community, civic and charitable activities that include membership in the Alternative Investment Management Association (AIMA) Commodity Futures Trading Commission (CFTC) working group, the Managed Funds Association CTA/CPO forum and the Connecticut Hedge Fund Association. He is also a former member of the New York City Bar Association’s Committee on Futures and Derivatives Regulation and its CPO/CTA subcommittee.

3:35pm - 4:00pm

Sustainable Investing Priorities & Generating Alpha

Keynote:

Afsaneh Mashayekhi Beschloss is founder and CEO of Rock Creek, a leading global investment and advisory firm that applies cutting-edge technology and innovation to investments. Previously, she was Managing Director and Partner at the Carlyle Group and President of Carlyle Asset Management, and Treasurer and Chief Investment Officer of the World Bank. Ms. Beschloss also worked at Shell International and J.P. Morgan. She has led global public policy and financial policy advising governments and central banks in energy, infrastructure and impact investing.

She serves on the boards of the Institute for Advanced Study in Princeton, the World Resources Institute, the American Red Cross, and is the Vice-Chair of the Public Broadcasting Service (PBS). Ms. Beschloss is a member of the World Economic Forum and the Council of Foreign Relations. She is a recipient of the Institutional Investor Lifetime Achievement Award, Robert F. Kennedy Ripple of Hope Award, and recognized as one of American Banker’s Most Powerful Women in Banking.

Ms. Beschloss holds an MPhil (Honors) in Economics from the University of Oxford, where she taught international trade and economic development. She is the co‐author of The Economics of Natural Gas and author of numerous journal articles on energy policy.

Moderated By:

Marcus Frampton, CFA, CAIA, FRM serves as the Chief Investment Officer of the Alaska Permanent Fund Corporation, where he manages a team of 25 investment professionals and is responsible for leading the firm’s investment activities. Mr. Frampton has been with APFC since 2012 and served as the Director of Investments, Real Assets & Absolute Return before his promotion to CIO in 2018.

Prior to joining APFC, Marcus held diverse roles ranging from investment banking with Lehman Brothers, private equity investing with PCG Capital Partners, and as an executive with LPL Financial, a private equity backed portfolio company.

Mr. Frampton holds a BA in Business-Economics with a minor in Accounting from UCLA. In addition to serving on the Board of Directors of Managed Funds Association, Marcus is also a Director of Scientific Industries, Inc. (OTC: SCND), a leading manufacturer of laboratory equipment and developer of intellectual property and products around bioprocessing; Nyrada, Inc., a privately-held drug development company; and Twin Creeks Timber, LLC, a privately-held owner/operator of institutional quality timberland assets.

4:00pm - 4:25pm

Allocating to Alternatives 2023

Speakers:

Anders W. Hall serves as Vanderbilt University’s vice chancellor for investments and chief investment officer. He leads the Office of Investments, where he is responsible for managing the university’s $7 billion long-term investment pool, including the endowment. Vanderbilt’s endowment serves as the financial underpinning for the university’s mission of teaching, cutting-edge research, and service.

Hall came to Vanderbilt in September 2013 from Duke University, where he worked for over a decade as head of public securities for DUMAC, the university’s investment management company. He oversaw public investments for the Duke University endowment, pension plan, health system’s long-term assets, and the Duke family foundation.

Prior to that, Hall was an investment consultant with Hewitt Investment Group in Rowayton, Connecticut, and Atlanta, Georgia, where he advised approximately 20 institutional clients. They included the New York Stock Exchange, Freddie Mac, and the University of Alabama System.

He also spent three years in the Prudential Advanced Management Development Program, a highly-selective leadership training program based in Newark, New Jersey.

Hall, a chartered financial analyst, double-majored in public policy studies and economics at Duke University, where he earned a bachelor of arts in 1993. He earned an MBA from the New York University’s Stern School of Business, where he majored in finance and economics and graduated with high honors in 1999.

Hall serves on the boards of Big Brothers Big Sisters of Middle Tennessee, the Pi Kappa Phi Foundation, Rock the Street Wall Street, and The Healing Trust. He previously served as a member of the governing board of Westminster Presbyterian Church and co-chaired the Annual Fund at University School of Nashville.

Hall lives in Nashville with his wife, Joanna, and their three children: Latham, Stewart, and Charlie.

Mr. Neale has over two decades of institutional investment experience and is responsible for the oversight and investment of more than $2.8B of investable assets on behalf of the University of Nebraska Foundation. In this role, his principal duties include establishing long-term asset allocation policies and short-term tactical tilts, manager research and selection, portfolio compliance and oversight, and serving as principal staff liaison to the Foundations Investment Committee. Additionally, Mr. Neale is part of the Foundations Executive Leadership Team. Mr. Neale has been with the Foundation since 2014, having joined most recently from MedStar Health (Baltimore, MD), and Wells Fargo Securities (Richmond, VA) prior to that. He Holds a Bachelors of Arts degree in History from the Virginia Military Institute and an MBA from The College of William & Mary. Proud to call himself a Midwesterner, he resides in Lincoln with his wife and two children.

Lamar Taylor is the Interim Executive Director and Chief Investment Officer of the State Board of Administration of Florida (SBA), a state constitutionally-created $250+ billion investment management organization providing investment and trust services to certain Florida governmental entities. Most notably, the SBA invests the funds for the Florida Retirement System Defined Benefit Pension Plan. Prior to being named Interim Executive Director and Chief Investment Officer, Lamar served as the SBA’s Chief Operating and Financial Officer.

Since joining the SBA in 2002, he has served in key roles throughout the organization and the Division of Bond Finance, including serving as the SBA’s Deputy General Counsel and Deputy Executive Director.

Lamar is an attorney and CPA with private and public sector experience. He received his law degree and masters in accounting degree from the Florida State University and his Bachelor of Science degree in accounting from the University of Florida. He also holds an LLM in taxation from the University of Florida.

Moderated By:

Mr. Stahler is the US Head of Strategic Consulting at Barclays. Mr. Stahler joined Barclays in 2008 as a member of the Strategy team working on various projects across the Investment Bank. Prior to joining Barclays, he worked as a consultant for McKinsey & Company, advising Asset Managers and other financial institutions as well as several other client types.

Mr. Stahler holds an MBA as well as a BA from the Stern School of Business at New York University.

4:25pm - 4:50pm

The Evolution of Macro Trading

Speaker:

Frederic is CIO and CEO of Alpstone Capital with 25 years of global markets experience. Prior to co-founding the firm in 2016, Frederic was a Partner and Portfolio Manager of a global macro portfolio at BlueCrest Capital Management (2008-2016). Prior to BlueCrest, Frederic was a senior derivatives trader at Barclays Global Investors (BGI), now BlackRock from 2003, predominantly responsible for establishing a Fixed Income derivatives capability, developing strategies to create hedge funds in Fixed Income and Credit. Prior to this he was a hedge fund strategies analyst at HDF Finance (Rothschild). Frederic started his career at Paribas (BNP Paribas) in 1998, initially in risk management before moving to trading, across a breadth of asset classes. He holds a post-graduate degree DESS 203 (1999) in Financial Markets from University Paris-Dauphine and the equivalent of a BSc. in Management Science (1996) and an MSc. Finance (1997) from Institut National des Telecoms.

Diego Parrilla, Principal Investment and Management Committee at 36 South Capital, a USD 2 billion hedge fund focused on volatility and tail risk strategies with a 21-year track-record and headquarters in London. Diego has 25+ years of investment experience in London, New York, Singapore, and Madrid, and held senior leadership roles in commodities, global macro, and volatility at JP Morgan, Goldman Sachs, Merrill Lynch, BlueCrest Capital, Dymon Asia, Old Mutual Global Investors, and Quadriga. Diego is co-author of “The Energy World is Flat” (Wiley, 2014), and “The Anti-Bubbles” (BEP, 2017), and a selective contributor to leading financial media, including the Financial Times (two Insight Columns), Wall Street Journal, CNBC, CNN, Real Vision, Hedgeye, and MacroVoices, amongst others. Diego holds MSc Mineral Economics from the Colorado School of Mines in Golden, MSc Petroleum Economics and Management from the French Institute of Petroleum in Paris, and MSc Mining and Petroleum Engineering from the Polytechnic University of Madrid, with a thesis on “Real Options applied to Mineral Asset Valuation”.

Sarah Schroeder is a Researcher and Portfolio Manager for One River Digital. Her focus is on the development of quantitative investment strategies applied to digital assets. Sarah was previously an executive director at AQR Capital, where she served on the portfolio management team for the firm’s systematic macro and trend strategies. In that role, she was primarily responsible for the firm’s alternative trend-following strategy and directional macro strategies. Before her tenure at AQR, Sarah worked on quantitative strategy development as part of Credit Suisse Asset Management’s Alternative Liquid Trading Strategies team. Her career began with quantitative modeling for a boutique economic consulting company that specializes in intellectual property valuation. Sarah graduated from the University of California at San Diego with high honors and received a B.S. in Management Science from the economics department as well as a B.A. in Public Law. Sarah also holds a Master’s in Financial Engineering from the University of California at Los Angeles.

Moderated By:

Noah Theran is MFA’s Executive Vice President and Managing Director, Head of Global External Affairs.

Noah joined MFA after six years at Internet Association, a national trade association representing more than 40 of the world’s top internet companies, where he oversaw global communications, creative, marketing, events, and grassroots. In this role, he helped grow Internet Association from a startup into a respected voice on tech policy issues.Prior to Internet Association, Noah was Director of Communications at the American Investment Council, the trade association representing the interests of the world’s largest private equity firms. There, his team earned a PRSA Silver Anvil Award of Excellence, Reputation/Brand Management for their campaign to help the private equity industry manage the spotlight of the 2012 presidential election.

Noah also worked at Rasky Baerlein Strategic Communications in Washington, where he developed and executed communications strategies for a diverse set of clients with broad reputation, image, and crisis management challenges.

Noah earned his B.S. from Cornell University in Ithaca, NY.

5:00pm - 6:30pm

Cocktail Reception

Sponsored by First Republic and Delta

Loews Miami Beach Hotel

Americana Lawn

9:00am - 9:15am

Welcome Remarks

Speaker:

Amy D’Annunzio is MFA’s Managing Director, Sponsorship and Conferences. She is based in the New York office and is responsible for managing and executing MFA’s marquee conferences. Amy works directly with the Chief Commercial Officer who leads the global Conferences and Events team.

Prior to MFA, Amy worked at Morgan Stanley as Vice President Firmwide Marketing and Events. At Morgan Stanley, Amy was responsible for the organization, production and execution of large scale events, conferences and meetings across all divisions, including the Firm’s Senior Management.

Amy graduated from the University of Massachusetts with a Bachelor’s degree from the Isenberg School of Management, with a concentration in Hospitality, Tourism and Event Management.

9:15am - 9:45am

Credit Market Impact: Investing Amid Inflation Shocks

Speakers:

As Head of Strategy at Magnetar Capital, Mr. Falk focuses on the firm’s strategic initiatives. He also serves as a member of its Investment and Management Committees, as well as the Magnetar Strategic Capital Investment Committee. Prior to joining Magnetar in 2017, Mr. Falk was Global Head of Private Credit and the Co-head of Leveraged Credit at KKR, where he spent over eight years of his career. Previously, he was the Co-head of Global Securitized Products at Deutsche Bank where he co-founded the Special Situations Group and launched the ABS CDO business. Mr. Falk began his career in 1992 with Credit Suisse First Boston in ABS Banking. He has served on the boards of the Loan Syndications and Trading Association (LSTA), Corporate Capital Trust and Corporate Capital Trust II – business development companies sub-advised by KKR – and various companies on behalf of Deutsche Bank. Mr. Falk is currently a member of the advisory committee of a private middle market lender and of the Investment Committee for The Public Theater.

Mr. Falk earned a BS and MS in Chemical Engineering from Stanford University.

Ms. Gunderson is a managing principal and member of the Investment Committee for CarVal Investors, responsible for leading the firm’s investment strategy and management, as well as its global loan portfolios and real estate businesses. In addition, Ms. Gunderson manages investments in asset-backed securities globally, including residential mortgage-backed securities, commercial mortgage-backed securities and collateralized loan obligations. Prior to joining CarVal Investors in 1994, Ms. Gunderson was a manager in the financial services practice of PriceWaterhouseCoopers where she served investment fund, commercial banking and thrift clients. Ms. Gunderson earned her B.S. degree in Business from the University of Minnesota and is a Certified Public Accountant (inactive).

CarVal Investors is a leading global alternative investment fund manager focused on distressed and credit-intensive assets and market inefficiencies. Since 1987, our experienced team has navigated through ever-changing credit market cycles, opportunistically investing $100 billion in 5,300 transactions across 77 countries. Today, CarVal Investors has approximately $10 billion in assets under management in both credit and real estate strategies.

Elizabeth Hewitt joined the Alfred P. Sloan Foundation in 2015 as Chief Investment Officer and Senior Vice President. As Chief Investment Officer, Hewitt is responsible for managing the Foundation’s endowment, including asset allocation strategy, fund manager selection, risk analysis, portfolio performance evaluation, and liquidity management. Prior to joining the Foundation, Hewitt was Managing Director of Public Investments at the Robert Wood Johnson Foundation where she selected and monitored investments with managers, participated on the institutions risk assessment committee and contributed to overall portfolio management. Earlier in her career, Hewitt was a Senior Vice President for Lazard Asset Management (2001-2006), a Hedge Fund Analyst for The Torrey Funds (1999-2001), and a Wealth Management Associate for the U.S. Trust Corporation (1998-1999). She holds an MA from the University of St. Andrews, Scotland. She is a Trustee of The Cary Institute of Ecosystem Studies, Millbrook NY and a member of the Investment Committees for The Madeira School, McLean VA and the Berkshire Taconic Community Foundation, Sheffield MA.

David Sultan is the Managing Partner and Chief Investment Officer of Fir Tree Partners, a value-oriented investment adviser founded in 1994. The Firm capitalizes on mispriced opportunities across capital structures and asset classes, using a long-term and team-oriented approach. Fir Tree manages assets on behalf of pension funds, endowments, foundations, families and other institutional investors. Mr. Sultan joined Fir Tree in 1999 and assumed the CIO role in 2015. Over his 22 year tenure at the Firm, Mr. Sultan has developed the Firm’s investment processes, culture and team. Mr. Sultan has led the Firm’s corporate and sovereign credit, capital structure arbitrage, distressed, special situation equity and SPAC investments globally and through multiple market cycles.

Earlier in his career, Mr. Sultan was an investment banker at Wolfensohn and Co. and an analyst at fundamental value investment firm Siegler, Collery & Co.

Mr. Sultan holds a B.A. in Economics from Harvard University.

Mr. Young is Chief Investment Officer of Orchard Global. He is also the Senior Portfolio Manager for the EleganTree Fund, the EleganTree 2015 Tactical Fund, the Black Forest Fund, and the Taiga Fund. Prior to joining Orchard Global, Mr. Young was at Merrill Lynch in London, where he started and developed the Structured Illiquid Credit Trading Desk. Before Merrill Lynch, Mr. Young was at Deutsche Bank in London where he helped form and lead a solutions-driven trading desk within Structured Credit Trading/Principal Finance. Prior to this role at Deutsche Bank, he was in the firm’s Global Relative Value Group. Earlier in his career, Mr. Young worked at Aon Risk Services, focusing on risk management strategies for corporations in the natural resource sector. Mr. Young holds a BA from the Plan II Honors Program at The University of Texas at Austin and has an MBA from The Wharton School of the University of Pennsylvania.

Moderated By:

John leads our North American cross-asset class commentary, with a particular focus on analyzing monetary policy, inflation and employment data. A highly sought-after commentator on financial television networks around the globe, John has also been instrumental in the development of our suite of iFlow indicators.

9:45am - 10:30am

Navigating a Turbulent Market: Outlook and Opportunities

Keynote:

Moderated by:

Mr. Richter is Chair of the Absolute Return Strategies Investment Committee, Co-Head of Absolute Return Strategies Research and serves on the Global Investment Council and the ESG Committee. He is also a member of the Strategic Investments Investment Committee. Mr. Richter approves portfolio allocations prior to implementation and shares responsibility for the evaluation, selection and monitoring of absolute return investment strategies and investment managers. Prior to joining GCM Grosvenor, he was the Founder and Managing Partner of Waveland Capital Management, L.P., a U.S. long/short equity hedge fund affiliated with GCM Grosvenor. Previously, he was a Manager with KPMG Peat Marwick, and then a Vice President of JMB Realty Corporation in the Corporate Acquisitions Group. Mr. Richter graduated summa cum laude with his Bachelor of Science in Accountancy from the University of Illinois at Urbana-Champaign. He is a Certified Public Accountant and received the national AICPA Elijah Watt Sells Award from the American Institute of CPAs for his scores on the Uniform CPA Examination.

10:30am - 11:00am

Investor Priorities for 2023

Speakers:

Nicholas oversees CPP Investments’ external allocations to Systematic Macroeconomic strategies and is also responsible for portfolio construction across the broader hedge fund program. Prior to joining CPP Investments in 2015, he started his career as an Analyst in the Credit Rating Assessment Group at the Bank of Canada. Nicholas holds a Master of Financial Economics from the University of Toronto and a Bachelor of Commerce from Mount Allison University. He is also a CFA® charterholder.

Farouki Majeed joined SERS as CIO in July 2012. Mr. Majeed came to SERS of Ohio from CalPERS, where he served as Senior Investment Officer – Asset Allocation and Risk management. Previously, Mr. Majeed was the inaugural CIO of the Abu Dhabi Retirement Pensions and Benefits Fund of the United Arab Emirates; Deputy Director, Investments, Ohio PERS; CIO Orange County Employees Retirement System; and Investment Officer of the Minneapolis Employees Retirement Fund. Majeed began his finance career in 1980 with the National Development Bank of Sri Lanka and worked in the Asia Division of Bank of America.

Andrew Palmer, CFA is the Chief Investment Officer for the Maryland State Retirement and Pension System. In this role, he is responsible for the day-to-day operations of the System’s investment division and has overall responsibility for the System’s investment program.

Previously he was the Deputy Chief Investment Officer, Director of Fixed Income for the Tennessee Consolidated Retirement System. In addition to his role as Director of Fixed Income, he led the construction of a Strategic Lending Portfolio, was a member of the Private Equity and Real Estate Committees and shared in the responsibility for tactical asset allocation and new product development. He began his career at ASB Capital Management, a Bethesda, Maryland based institutional advisory firm.

Mr. Palmer is a member of the University of Maryland, Economics Leadership Council, and the ILPA, has been active in the CFA program and was President of the Washington Association of Money Managers. He received a BA and an MA in Economics from the University of Maryland.

Justin Young is the Director for Portable Alpha at the South Carolina Retirement System Investment Commission where he spearheaded a restructuring effort for the top-quartile, $4bn hedge fund program. Prior to his current role he has covered multiple asset classes including core fixed income, commodities, GTAA, equity options, and other opportunistic investments. Before joining RSIC Justin was a Research Analyst at Bridgewater Associates. Justin is a CAIA charter holder and a graduate of the University of South Carolina Honors College where he doubled majored in Finance and Economics.

Moderated By:

Mithra Warrier is a Managing Director in Citi Prime Finance Origination, and is also Head of North American Capital Introductions. Mithra joined Citi in January, 2022, from TD Securities, where she oversaw Sales, Capital Introductions, and Client Services for the U. S. Prime Services business. Prior to joining TD Securities in November 2017, Mithra spent 15 years at Barclays, which she joined in 2008 through the acquisition of Lehman Brothers. During her time at Lehman Brothers and Barclays, Mithra worked in several areas of Financing, including Repo Salestrading, Credit Financing, Prime Origination, and Prime Account Management. Mithra graduated from Northwestern University in 2002 with a Bachelor of Arts degree in Economics.

11:00am - 11:35am

Structured Credit Outlook

Speakers:

In his role as Co-Chief Investment Officer, Yale is responsible for leading the research and execution process across the structured credit platform at Anchorage. He is a voting member of Anchorage’s Investment Committees. He is a member of the U.S. CLO and CDO Investment Committee and Chair of the European CLO Investment Committee. Yale joined Anchorage as Head of Structured Credit in November 2008. Prior to joining Anchorage, Yale worked at JP Morgan and in his most recent role was responsible for the global CLO business. Prior to joining JP Morgan, he was an investment banker in Deutsche Bank’s CDO business. He also held various positions in investment banking including in the CDO business at Goldman Sachs. Yale has a total of 25 years of experience in the financial services industry and received a B.S. in Economics from the Wharton School at the University of Pennsylvania, where he graduated summa cum laude, and he holds the Chartered Financial Analyst designation.

Jordan Barrow joined Shenkman Capital in 2004. He has over 18 years of leveraged finance investing experience and has been a portfolio manager since 2011. Mr. Barrow has experience managing portfolios for the Firm’s High Yield, Short Duration, and Convertible strategies. He started his career as a high yield research analyst specializing in Healthcare and has also covered Retail, Technology and Service Industries. In 2010, Mr. Barrow was instrumental in launching the firm’s Short Duration High Yield Strategy. He was also key in the launches of the Global Convertible and Investment Grade Convertible Strategies, in 2015 and 2014, respectively. Mr. Barrow is a member of Shenkman Capital’s Risk Committee and currently serves on the board of the Friends of Mount Sinai Health System. Mr. Barrow received a BA degree in Economics and International Relations from the University of Pennsylvania. In addition, he is a CFA charterholder (2007).

Young Choi is a Partner, Senior Trader, and the Portfolio Manager of Rockford Tower Capital Management. Young is a member of the Global Investment Committee, U.S. Investment Committee, CLO Investment Committee and Risk Committee.

Prior to joining King Street in 2006, Young worked at Citadel Investment Group, as a Credit Analyst in the Distressed/High Yield Group and Portfolio Manager of the firm’s $2 billion U.S. leveraged loan portfolio and CLO. Prior to that, Young consulted at Bain & Co.

Young received a B.A. summa cum laude in Economics and a B.S.E. in Electrical Engineering from Duke University.

Mr. Ross is a Portfolio Manager and Co-Head of Structured Credit. Mr. Ross joined Brigade in 2008 and along with Mr. Bleier developed the firm’s structured credit investing capabilities, including proprietary analytic tools and risk systems. He launched Brigade’s dedicated Structured Credit fund in 2014 and oversees a team of 12 individuals who are responsible for identifying and sourcing opportunities across all structured credit markets, including ABS, CLOs, CMBS, RMBS, Specialty Finance, and Synthetic Structured Credit. Mr. Ross also oversees the structuring of Brigade’s global CLO management platform. Prior to joining Brigade, Mr. Ross was a member of the Global Structured Products Group at Banc of America Securities where he originated and traded CLOs and CDOs. Mr. Ross sits on the leadership council for Success Academy Charter Schools in New York City. Mr. Ross received a BA in Mathematical Economics from Pomona College.

Moderated By:

11:35am - 12:05pm

The Manager and Investor Perspective on Quant Investing

Speakers:

Pablo E. Calderini is the President and Chief Investment Officer of Graham Capital Management, L.P. (“GCM”), an alternative investment firm with approximately $17 billion in AUM as of August 1, 2021. Mr. Calderini is responsible for the management and oversight of the discretionary and systematic trading businesses at GCM, among other things. Mr. Calderini is also a member of the firm’s Executive, Investment, Risk and Compliance committees. He joined GCM in August 2010 and became an Associated Person and Principal of GCM effective August 13, 2010. Prior to joining GCM, Mr. Calderini worked at Deutsche Bank from June 1997 to July 2010 where he held positions of increasing responsibility, most recently the Global Head of Equity Proprietary Trading. Mr. Calderini commenced his career at Deutsche Bank as Global Head of Emerging Markets. During his tenure at Deutsche Bank, Mr. Calderini also helped manage several groups across the fixed income and equity platforms, including the Global Credit Derivatives Team. Mr. Calderini received a B.A. in Economics from Universidad Nacional de Rosario in 1987 and a Masters in Economics from Universidad del CEMA in 1989, each in Argentina.

Subhasis Das is currently a Senior Portfolio Manager within the Strategic Investments asset class at the State Board of Administration of Florida (SBA). Subhasis’ primary responsibilities are researching, sourcing and oversight for a variety of hedge fund and private credit strategies. Prior to his current role, he spent ten years as the Director of Research in the Global Equity asset class where his responsibilities included analysis of global equity portfolios, researching portfolio strategies, oversight of external active managers and asset class risk management. Subhasis worked as a business economist for government agencies and a bank before his time at the SBA. Subhasis’ educational background consists of a PhD degree in economics, a MBA and a MS in computer science.

Mr. Granger is a managing director in the Newport Beach office and leads PIMCO’s quantitative portfolio management team. He is the lead portfolio manager of PIMCO’s flagship quantitative hedge fund strategy, along with oversight and portfolio management responsibilities across PIMCO’s range of systematic funds. Prior to joining PIMCO in 2020, Mr. Granger was based in London as chief investment officer and head of research at AHL, the systematic division of Man Group. In this role he was also portfolio manager of the firm’s quantitative multi-strategy fund, and a specialist in systematic volatility strategies. Prior to Man Group, he was an equity derivatives strategist at J.P. Morgan. He has 18 years of investment experience and holds a bachelor’s degree in mathematics from Oxford University, a master’s degree in philosophy from Kings College London, and a Ph.D. in mathematical logic from the University of Manchester.

Andrew W. Lo is the Charles E. and Susan T. Harris Professor at the MIT Sloan School of Management and director of the MIT Laboratory for Financial Engineering. He received his Ph.D. in economics from Harvard University in 1984. Before joining MIT’s finance faculty in 1988, he taught at the University of Pennsylvania’s Wharton School as the W.P. Carey Assistant Professor of Finance from 1984 to 1987, and as the W.P. Carey Associate Professor of Finance from 1987 to 1988.

He has published numerous articles in finance and economics journals, and has authored several books including Adaptive Markets: Financial Evolution at the Speed of Thought, The Econometrics of Financial Markets, A Non-Random Walk Down Wall Street, Hedge Funds: An Analytic Perspective, and The Evolution of Technical Analysis. He is currently co-editor of the Annual Review of Financial Economics and an associate editor of the Financial Analysts Journal, the Journal of Portfolio Management, and the Journal of Computational Finance.

His awards include the Alfred P. Sloan Foundation Fellowship, the Paul A. Samuelson Award, the American Association for Individual Investors Award, the Graham and Dodd Award, the 2001 IAFE-SunGard Financial Engineer of the Year award, a Guggenheim Fellowship, the CFA Institute’s James R. Vertin Award, the 2010 Harry M. Markowitz Award, and awards for teaching excellence from both Wharton and MIT.

Moderated By:

Ric Ochman, CFA is an Executive Director in the J.P. Morgan Capital Advisory Group. Prior to joining J.P. Morgan Ric was the Global Head of Hedge Funds for AIG Investments. Before that Ric was a research analyst at Adair Capital. Ric started his career as a quantitative research analyst at State Street Global Advisors. Ric has an MBA from New York University and a BSBA from Boston University. He lives in New York City.

12:05pm - 1:15pm

Luncheon: The Outlook for Alpha

Keynote:

Luke Ellis is Chief Executive Officer of Man Group, a global active investment firm. Man Group has five investment engines (Man AHL, Man Numeric, Man GLG, Man FRM and Man GPM), which manage USD 135.3 billion (as at 30 June 2021) in a range of liquid and private markets. With a central objective to deliver alpha for clients through time, Man Group provides a wide range of alternative and long-only portfolio solutions for its client base. As CEO, Luke leads the firm’s Executive Committee, working with teams across investment, distribution, technology and infrastructure, while seeking to deliver the right outcomes for clients and positioning Man Group to adapt to opportunities as markets evolve. He is also the Deputy Chairman of the Standards Board for Alternative Investments (SBAI), and Chair of the Board of Trustees for Greenhouse Sports. Luke joined Man Group in 2010 and was previously President of the firm, responsible for management across investment engines. Prior to this, he was Chairman of Man GLG’s Multi-Manager activities and was Managing Director of Man FRM from 1998 to 2008. Luke was previously a Managing Director at JPMorgan in London and Global Head of the firm’s Equity Derivatives and Equity Proprietary Trading businesses. He holds a BSc (Hons) in Mathematics and Economics from Bristol University.

Moderator:

Mark Baumgartner is Carnegie’s Chief Investment Officer, responsible for oversight of the foundation’s endowment.

Prior to joining Carnegie, he was CIO at the Institute for Advanced Study, an institution supporting research in science and the humanities in Princeton, New Jersey. Previously, he served as Director of Asset Allocation and Risk at the Ford Foundation, and co-Head of Morgan Stanley’s Global Portfolio Solutions group.

Prior to Morgan Stanley, Mark was a Portfolio Manager at two hedge funds, Quantal Asset Management, a quantitative equity market neutral fund, and Strategy Capital, a fundamental equity fund. He began his career as a management consultant.

Mark is a member of the Board of Directors of Scientific Technologies Ltd, a startup focused on developing technologies that will have a transformative impact at global scale, a member of the Board of Directors of The Investment Fund for Foundations (TIFF), a Trustee and Chair of the Investment Committee for the YMCA Retirement Fund, and served on the Board of Directors and Investment Program Committee for the Foundation Financial Officers Group (FFOG).

He received a Ph.D. in Aerospace Engineering and a Certificate in Public Policy from Princeton University. He also holds the Chartered Financial Analyst designation.

1:15pm - 1:50pm

The Evolution of the Event Driven Landscape

Speakers: