MFA Global Summit Paris 2023 - Agenda

Agenda

- Tuesday, May 16

9:00

Registration

9:50 – 10:00

Welcome Remarks

Speaker:

Jillien Flores serves as Executive Vice President, Managing Director, Head of Global Government Affairs at MFA.

Flores joined MFA after six years at Vanguard, one of the world’s leading asset managers. There, she advocated before Washington policymakers on a range of issues related to US capital markets, tax, and retirement policy. Leveraging policy depth, strategy, and relationships, Flores achieved policy outcomes beneficial to Vanguard’s clients on issues including equity market structure, ESG and corporate governance, and systemic risk.

Throughout her career, Flores has sought opportunities to advance Diversity, Equity, and Inclusion within the financial services sector, serving in leadership roles of related efforts at Vanguard.

Prior to joining Vanguard, Flores was Director of Government Relations at Porterfield, Lowenthal, Fettig & Sears, where she represented clients before Congress and the federal financial regulators in the asset management, insurance, securities, and biotechnology sectors. She was involved in the legislative and rule-writing process for several financial services laws and regulations, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Jumpstart Our Business Startups Act.

Flores earned a B.A. from the George Washington University in Washington, DC.

10:00 – 10:25

Keynote Address

Speaker:

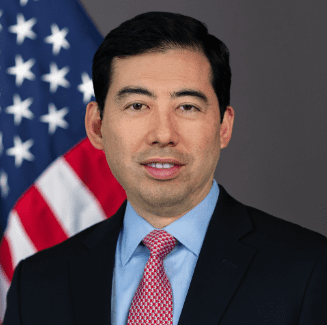

Mark T. Uyeda was sworn into office on June 30, 2022. He was nominated by President Joseph Biden and confirmed by the U.S. Senate.

Commissioner Uyeda has served on the staff of the SEC since 2006, including as Senior Advisor to Chairman Jay Clayton, Senior Advisor to Acting Chairman Michael S. Piwowar, Counsel to Commissioner Paul S. Atkins, and various staff positions in the Division of Investment Management. He most recently served on detail from the SEC to the Senate Committee on Banking, Housing, and Urban Affairs as a securities counsel to the committee’s minority staff.

Prior to joining the SEC, Commissioner Uyeda served as Chief Advisor to the California Corporations Commissioner, the state’s securities regulator. He also worked as an attorney at the law firms of K&L Gates (formerly known as Kirkpatrick & Lockhart LLP) in Washington, D.C., and O’Melveny & Myers LLP in Los Angeles.

Commissioner Uyeda earned his bachelor’s degree in business administration at Georgetown University and his law degree with honors at the Duke University School of Law.

He is the first Asian Pacific American to serve as a Commissioner at the SEC.

10:25 – 10:45

The Outlook for European Distressed Funds and Credit Investing

A Fireside Chat

Speaker:

In his role as Co-Chief Investment Officer, Thibault is responsible for overseeing the firm’s portfolio management, risk management, asset allocation, and investment decisions with respect to the Successor Funds. He is responsible for the management of the ACO funds as well as stressed and distressed credit products. Thibault is also responsible for the research and trading process supporting Anchorage’s Legacy Funds, ACP and AIO products. He is a voting member of Anchorage’s Investment Committees, the Proxy Voting Committee, the Allocation Committee, and Co-Chair of the Research Review Committee. Thibault joined Anchorage in January 2009 to help establish the firm’s London office and develop the firm’s European research and investment efforts. Prior to joining Anchorage, Thibault was a Vice President at Greywolf Capital. Prior to joining Greywolf, he was an Analyst on the distressed bond desk at Goldman Sachs in New York. Thibault has a total of 22 years of experience in the financial services industry and received a B.S. in Engineering and a B.A. in Economics from Brown University, where he graduated magna cum laude.

Moderated By:

10:45 – 11:00

Keynote Address

Speaker:

Alexandra Jour-Schroeder is Deputy Director General of the European Commission´s Directorate-General for Financial Stability, Financial Services and Capital Markets Union since March 2021. In her function, Alexandra Jour-Schroeder supervises and monitors the policies of the Directorate General.

Alexandra Jour-Schroeder is a graduate in law. Following initial assignments in the German federal government, she started working for the European Commission in 1996, holding several positions in competition, enterprise and industry policies as well as justice. From 1998 to 2007, she was Member of Cabinet for the Commissioners responsible for regional policy and justice and home affairs and for the Vice-President for enterprise and industry. Since 2017, she has been the Director for Criminal Justice in the Directorate-General for Justice and Consumers, working inter alia on the establishment of a European Public Prosecutor´s Office and Anti-Money Laundering policies. From 2018 to 2021, she was also overseeing consumer policies as Acting Deputy Director General in DG Justice and Consumers.

11:00 – 11:30

Building the Future: Working Towards Open, Competitive and Sustainable Capital Markets in Europe

Speakers:

Camille is the Director – Wholesale Buy Side for the Financial Conduct Authority. She has 20 years of experience in financial services regulation having previously held senior regulatory roles for the Central Bank of Ireland and Australian Treasury. Camille was the Leader of the Investment Banking Division of ASIC over the financial crisis of 2008.

Camille has also held positions as Global Chief Compliance Officer for two large investment management groups in the UK and for a large Australian Investment Bank. She holds a Master of Laws from the LSE and Master of Commerce from UNSW.

Jérome Reboul is Managing Director of the Regulatory Policy and International Affairs Directorate at the French Autorité des Marchés Financiers (AMF) since July 1 2021. The Directorate covers all areas of securities regulation including market intermediaries and infrastructures, asset management, transparency requirements for issuers, as well as Fintechs and sustainable finance.

Prior to joining the AMF, Jérôme worked 11 years for the French Treasury, first as deputy head of the Banking Affairs Office, in charge of national and international banking regulation, before being appointed to manage the Savings and Financial Markets Office in May 2013, and then the Housing and Public Interest Activities Financing Office. In June 2016 he was appointed Deputy Director at the Agence des participations de l’État (French government shareholding agency). He then held the position of Deputy Secretary in charge of banks within the Treasury from August 2017 onwards.

He started his career in June 2007 at the Ministry of Public Works as a Project Manager in the Department of Urban Planning and Housing, then in July 2008, as a Project Manager at the Agence des participations de l’État. Jérôme Reboul, an alumni of the Ecole Normale Supérieure, holds a PhD in economics from the University of Toulouse and a Master’s degree in public affairs from the École Nationale des Ponts et Chaussées.

Moderated By:

Taggart Davis serves as Managing Director, Head of EU Government Affairs at Managed Funds Association (MFA). He is responsible for the development and execution of MFA’s policy engagement strategy for Brussels and the European Union.

Prior to joining MFA, Taggart headed the J.P. Morgan Chase & Co. government relations office in Brussels for a decade and advocated on a range of policy issues, including investment management, banking, transatlantic relations and EU-UK relations. During his time with J.P. Morgan, he also served as Director and Vice Chairman of the Board of the American Chamber of Commerce to the EU (AmCham EU). He also worked in the European Parliament as a Parliamentary Assistant from 2008-2011, where he helped negotiate the Alternative Investment Fund Managers Directive (AIFMD), the Short Selling Regulation (SSR) and other EU financial legislation.

Taggart earned a B.A. in Spanish from the University of Montana and an M.A. in Comparative Politics from the University of Essex (UK).

11:30 – 11:50

Keynote Address

Speaker:

Ashley Alder became Chair of the FCA Board in February 2023.

Ashley was previously the Chief Executive Officer of the Securities and Futures Commission (SFC) in Hong Kong, a role he has held since 2011.

He also chaired the Board of the International Organization of Securities Commissions (IOSCO).

Ashley began his career as a lawyer in London in 1984 and practised in Hong Kong for more than 20 years. He was Executive Director of the SFC’s Corporate Finance Division from 2001 to 2004, before returning to private practice at Herbert Smith LLP, a law firm, as Head of Asia.

11:50 – 12:20

Navigating Geopolitical Crossroads: Where does Europe go from Here?

Speakers:

Phil Hogan is a former Member of European Commission. He served in the portfolios of Agriculture & Trade from 2014 to 2020 respectively.

During that time he was involved in managing the Common Agriculture Policy and its Budget(410 Billion Euro), opening new market opportunities for food exporters arising from the Russian Embargo, assisting in the negotiations of several trade deals with various countries including China, Japan, Vietnam, Singapore, Mexico, Mercusor. Phil forged a new relationship with the United States of America in respect of trade and technology.

For 27 years, Phil Hogan was a Member of the National Parliament of Ireland and Minister for Environment & Local Government from 2011 to 2014.

He was born in Kilkenny, Ireland and is a graduate of University College, Cork (BA, Econs). Presently he is Managing Director of a business consultancy firm.

Moderated By:

12:20 – 13:15

Lunch

13:15 – 13:20

Keynote Address

Speaker:

Jean-Paul Servais is the chairman of the Financial Services and Markets Authority of Belgium (FSMA).

Internationally, he holds mandates as vice chair of the IOSCO Board, as well as chairman of the IFRS Foundation Monitoring Board, the IOSCO European Regional Committee and the Audit Committee of IOSCO.

He is also a board member of several international supervisory bodies for the financial sector: ESMA, ESRB, etc. Within ESMA, he currently chairs the Financial Innovation Standing Committee (FISC). He also chairs the Euribor and Eonia Benchmarks colleges and is member of the Euronext College of Supervision.

He teaches at the Université Libre de Bruxelles (ULB, University of Brussels), where he is part-time professor in the LL.M in International Business Law and in the specialized Master in Tax Law. He is author or co-author of more than 300 contributions, in particular in areas of relevance to the European and international system of financial supervision, to the FSMA’s activities and to the academic and scientific activities undertaken at the ULB.

He obtained a Master of Law (Master en droit) from the ULB and a Master of Economics in Business Management (Master in de economie, bedrijfskunde) from the Vrije Universiteit Brussel (VUB).

13:20 – 13:25

Keynote Address

Speaker:

Vasileios Madouros was appointed Deputy Governor, Monetary and Financial Stability in November 2022. In this role, he oversees the Economics & Statistics, Financial Stability and Financial Operations Directorates and leads engagement with domestic, Eurosystem and broader international stakeholders representing the Central Bank on wider financial system matters. Vasileios is an ex-officio Member of the Central Bank Commission and is the Governor’s alternate at the Governing Council of the European Central Bank.

Prior to this appointment, Vasileios was Director of Financial Stability. In this role, he was responsible for the Central Bank’s work to monitor threats to financial stability and provide advice on the use of macro-prudential tools, or other policy interventions, to mitigate those risks. Vasileios was also responsible for enhancing the Central Bank’s financial crisis preparedness and management capabilities as well as preparing for, and managing, the orderly resolution of relevant financial institutions. In this role, Vasileios was a member of the Plenary Board of the Single Resolution Board.

Prior to joining the Central Bank, Vasileios spent most of his career at the Bank of England. His work at the Bank of England spanned a range of areas related to financial stability, covering macro-prudential policy development, stress testing, international finance, prudential policy and macro-financial risk assessment.

Vasileios holds a B.Sc. in Economics from the University of Warwick and a M.Sc. in Economics from Birkbeck College, University of London.

13:25 – 13:55

Assessing Market Stress: Are Financial Markets Resilient?

Speakers:

Vasileios Madouros was appointed Deputy Governor, Monetary and Financial Stability in November 2022. In this role, he oversees the Economics & Statistics, Financial Stability and Financial Operations Directorates and leads engagement with domestic, Eurosystem and broader international stakeholders representing the Central Bank on wider financial system matters. Vasileios is an ex-officio Member of the Central Bank Commission and is the Governor’s alternate at the Governing Council of the European Central Bank.

Prior to this appointment, Vasileios was Director of Financial Stability. In this role, he was responsible for the Central Bank’s work to monitor threats to financial stability and provide advice on the use of macro-prudential tools, or other policy interventions, to mitigate those risks. Vasileios was also responsible for enhancing the Central Bank’s financial crisis preparedness and management capabilities as well as preparing for, and managing, the orderly resolution of relevant financial institutions. In this role, Vasileios was a member of the Plenary Board of the Single Resolution Board.

Prior to joining the Central Bank, Vasileios spent most of his career at the Bank of England. His work at the Bank of England spanned a range of areas related to financial stability, covering macro-prudential policy development, stress testing, international finance, prudential policy and macro-financial risk assessment.

Vasileios holds a B.Sc. in Economics from the University of Warwick and a M.Sc. in Economics from Birkbeck College, University of London.

Costas Stephanou is the Head of Financial Stability Analysis in the Financial Stability Board (FSB) Secretariat. In that capacity, he oversees the FSB’s work on vulnerabilities assessments, implementation monitoring and evaluations of the effects of G20 financial reforms. He also coordinates the FSB’s analytical and policy work to enhance the resilience of non-bank financial intermediation. Mr Stephanou previously worked as a Senior Financial Economist at the World Bank; as a risk management consultant for Oliver Wyman; and as Treasury Risk Manager and Head of Planning for an HSBC affiliate in Greece. Mr Stephanou holds degrees in Economics and Public Policy from the universities of Cambridge and Harvard respectively.

Moderated By:

Tarik El Mejjad is a Director and senior equity research analyst on the European banks team. He is responsible for French and Benelux banks. Before joining Bank of America Merrill Lynch in July 2013, El Mejjad worked at Lehman Brothers and Nomura as an equity research analyst covering Benelux and French mutual banks. He has also worked at Prudential Plc as a risk actuary and, prior to that, at Ernst & Young in Paris. El Mejjad holds a master’s degree in Finance and Mathematics from l’EISTI in France. He also passed his actuarial exams at the Centre d’Etudes Actuarielles in Paris. He is based in London. He speaks fluent French, Arabic and English.

13:55 – 14:20

Fireside Chat with Luke Ellis

Speaker:

Luke Ellis is Chief Executive Officer of Man Group, a global active investment firm. Man Group has five investment engines (Man AHL, Man Numeric, Man GLG, Man FRM and Man GPM), which manage USD 135.3 billion (as at 30 June 2021) in a range of liquid and private markets. With a central objective to deliver alpha for clients through time, Man Group provides a wide range of alternative and long-only portfolio solutions for its client base. As CEO, Luke leads the firm’s Executive Committee, working with teams across investment, distribution, technology and infrastructure, while seeking to deliver the right outcomes for clients and positioning Man Group to adapt to opportunities as markets evolve. He is also the Deputy Chairman of the Standards Board for Alternative Investments (SBAI), and Chair of the Board of Trustees for Greenhouse Sports. Luke joined Man Group in 2010 and was previously President of the firm, responsible for management across investment engines. Prior to this, he was Chairman of Man GLG’s Multi-Manager activities and was Managing Director of Man FRM from 1998 to 2008. Luke was previously a Managing Director at JPMorgan in London and Global Head of the firm’s Equity Derivatives and Equity Proprietary Trading businesses. He holds a BSc (Hons) in Mathematics and Economics from Bristol University.

Moderated By:

LEONARD NG is a member of Sidley Austin LLP’s Executive Committee and heads the firm’s UK/EU Financial Services Regulatory Group. Based in the firm’s London office, Leonard advises a wide range of global financial institutions on complex UK/EU financial services regulatory issues. He has particular experience in advising clients on operating under the regulatory framework established after the last financial crisis, and more recently on Brexit, sustainable finance/ESG, and crypto-asset regulation. Leonard is a past member of the Board of MFA, the trade association for the global alternative asset management industry, and is a frequent speaker at industry conferences. Leonard has received acknowledgements from numerous industry ranking guides, including Chambers UK (2012–2024). In 2022 and again in 2023, Leonard was selected by Financial News as one of Financial News’ ‘Fifty Most Influential Lawyers’. Leonard earned a LLB from the National University of Singapore Faculty of Law and an LLM from the University of Chicago Law School.

14:20 – 14:50

Filling the Financing Gap: The Outlook on Direct Lending in an Uncertain Market

Speaker:

Tom Maughan is a Partner at Bain Capital Credit and leads the European Private Credit business. Prior to joining Bain Capital, Tom was a Managing Director at J.P. Morgan responsible for leading the European team of J.P. Morgan Mezzanine (part of the Global Special Opportunities Group, a private credit investment business of J.P. Morgan). Tom joined as a graduate and initially worked in Investment Banking for 6 years (mostly in TMT) focused on executing private equity and corporate transactions in M&A, LBOs, debt restructuring and capital markets execution (debt and equity) before joining the European mezzanine business from its inception in 2005.

Mr. Sbrocchi is Head of Lending in EMEA and a Portfolio Manager at Orchard Global. Prior to joining Orchard Global in 2017, Mr. Sbrocchi was at Merced Capital from 2011 to 2017, where he was responsible for sourcing, executing, and managing stressed and distressed public credit, private debt, and equity investments across multiple industry sectors and geographies. Before Merced Capital, Mr. Sbrocchi was at Houlihan Lokey as an Analyst in its Financial Restructuring Group.

He holds a BA in Finance from the Interdisciplinary Honors Program at Loyola University of Chicago.

Ms. Walsh is a member of the private debt team and focuses on illiquid credit investments.

Prior to StepStone, Ms. Walsh was an associate within Goldman Sachs International’s credit finance division, where she worked on the sourcing and execution of leveraged finance transactions across high yield and leveraged loans in the EMEA region, as well as managing the portfolio of credits. Before that she was a member of the transaction, monitoring, restructuring team within Project Finance at the European Investment Bank in Luxembourg.

Ms. Walsh holds a degree in business studies (BBS, M.A. (Dubl.)) from Trinity College Dublin.

Moderated By:

Ranesh Ramanathan is the co-leader of Akin’s integrated special situations & private credit practice. He has deep and diverse experience advising global asset managers on a wide variety of matters, as well as advising private equity firms and their portfolio companies in a range of traditional large cap and middle-market acquisition and financing transactions.Ranesh has extensive experience negotiating, structuring and managing complex transactions globally—across the United States, Europe, Asia and Australia—including acquiring diverse multijurisdictional portfolios of assets and extracting entire business units from distressed sellers. In addition to his work across the credit spectrum, he has managed the legal aspects of investments in publicly traded and pre-IPO companies, and has worked with a variety of fund types, including closed-ended, open-ended and managed accounts in a wide variety of strategies.

Ranesh returned to private practice in 2018 after nearly 15 years in in-house legal roles with Bain Capital and Citigroup. Ranesh was a managing director at Bain Capital and generalcounsel to Bain Capital’s credit and public markets businesses.

14:50 – 15:05

Networking Break

15:05 – 15:10

Investor Market Trends

Speaker:

15:10 – 15:40

AIFMD: Fostering Cross-Border Investment with Global Market Access

Speakers:

Hunter Landrum serves as Associate General Counsel at Two Sigma, an investment manager specializing in trading assets in liquid global markets across a range of conditions using a disciplined, scientific approach. Hunter is responsible for the firm’s engagement with governments and regulators as well as litigation and enforcement matters. Hunter serves as Chair of the MFA’s EMEA-APAC Forum and is an active participant in the global financial regulatory community. He is currently based in London having previously practiced in New York City and Washington D.C.

Hunter joined the firm in 2015. Before joining Two Sigma, Hunter was an attorney at WilmerHale in Washington D.C. In this role, he focused on government affairs and representing international financial institutions in high-profile investigations before a variety of domestic and international regulators. Hunter holds a J.D. from the University of Virginia School of Law and a B.A. in Political Science from the University of Alabama.

Laurent van Burik is head of unit legal/international/enforcement and ESG of the CSSF Collective Investment Schemes unit. He is with the CSSF since 2010. Prior to that, Laurent had spent 15 years as legal counsel with asset service providers (ICSD/global custodians/Big Four) in Luxembourg, London and Frankfurt. He represents the CSSF in various committees, including at international level the ESMA Investment Management Standing Committee and the IOSCO Assessment Committee. Laurent holds a Master Degree in International Tax Law from University Paris XI-HEC Paris and was admitted to bar in 2001.

Moderated By:

15:40 – 16:10

Market Structure & MiFIR: Driving Growth and Competitiveness in EU Capital Markets

Speakers:

Stephen Berger is a Managing Director and Global Head of Government & Regulatory Policy at Citadel. He leads the firm’s engagement on legislative and regulatory initiatives impacting the financial industry globally, including the Dodd-Frank Act in the United States and EMIR and MiFID II in Europe.

Mr. Berger has testified before the House Agriculture Committee on the impact of the G-20 clearing and trade execution requirements, presented before CFTC advisory committee meetings on issues including package transactions and position limits, participated in workshops at the New York Fed and Chicago Fed on CCP recovery and resolution, and spoken on panels at MFA, FIA, and ISDA conferences on topics ranging from cross-border harmonization to margin requirements for uncleared swaps.

Mr. Berger is a member of the CFTC’s Market Risk Advisory Committee, NFA’s CPO / CTA Advisory Committee, and the Federal Reserve Bank of Chicago’s Working Group on Financial Markets. He has served as Chair of the Managed Funds Association’s Derivatives and Swaps Committee and is an active participant in a number of MFA, AIMA, SIFMA AMG, and ISDA committees.

Prior to joining Citadel, Mr. Berger was an Executive Director at UBS Investment Bank, where he led UBS’s US financial regulatory reform team.

Sébastien was previously head of the Insurance Markets and Products Unit (2009-2012) and of the Corporate Financing Unit at the Directorate-General of the Treasury (2012-2013), where he also served as General Secretary of the Interministerial Committee for Industrial Restructuring. He was appointed deputy assistant secretary in 2013 (until 2018), in charge of Financial Markets and Corporate Financing.

He graduated in 1997 from Ecole Polytechnique.

Moderated By:

Cecile joined Citi in February 2022 and is currently Head of Markets for France, Belgium and Luxembourg. She is based in Paris and provides regional leadership and governance in full partnership with the product areas, across all customer segments including investors,

corporates, and public sector clients. Cecile is a member of the Country Committee.

Prior to Citi, Cecile spent over a decade at Bank of America Merrill Lynch, where she served in different capacities as a Managing Director in Core Europe and Emerging Markets. She started her career at JPMorgan in London, notably in Equity Structuring and FICC Solutions.

Cecile graduated from Harvard Business School in Boston and Panthéon-Assas University in Paris. She is fluent in French, Italian, Spanish and English.

16:10 – 16:30

Fireside Chat with Fahmi Quadir

Moderated By:

Jillien Flores serves as Executive Vice President, Managing Director, Head of Global Government Affairs at MFA.

Flores joined MFA after six years at Vanguard, one of the world’s leading asset managers. There, she advocated before Washington policymakers on a range of issues related to US capital markets, tax, and retirement policy. Leveraging policy depth, strategy, and relationships, Flores achieved policy outcomes beneficial to Vanguard’s clients on issues including equity market structure, ESG and corporate governance, and systemic risk.

Throughout her career, Flores has sought opportunities to advance Diversity, Equity, and Inclusion within the financial services sector, serving in leadership roles of related efforts at Vanguard.

Prior to joining Vanguard, Flores was Director of Government Relations at Porterfield, Lowenthal, Fettig & Sears, where she represented clients before Congress and the federal financial regulators in the asset management, insurance, securities, and biotechnology sectors. She was involved in the legislative and rule-writing process for several financial services laws and regulations, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Jumpstart Our Business Startups Act.

Flores earned a B.A. from the George Washington University in Washington, DC.

Speaker:

Fahmi Quadir is the Founder and Chief Investment Officer of Safkhet Capital Management. The primary fund is short-only, focused on high-conviction opportunities where investigative and forensic methods are used to assess possible fraud, criminality, and consumer abuse, among other predatory activities. Fahmi regularly advocates for a deeper understanding of the market utility of short selling, including pushing for fairer short selling treatment and stronger fraud reporting protocols.

16:30 – 17:00

The Big Short: Reevaluating Ground Rules to Unlock Market Potential

Speakers:

Kevin Krist is a senior vice president and the Chief Legal and Compliance Officer of D. E. Shaw & Co. (London), LLP. Operating from the firm’s London office, Mr. Krist focuses on transactional and regulatory matters principally with respect to the D. E. Shaw group’s investment management activities in Europe. Prior to joining the D. E. Shaw group in 2010, he served as the general counsel at Fortrinn Partners LLP, a London-based alternative investment management firm. Before that, Mr. Krist was the associate general counsel at MKM Longboat Capital Advisers LLP, a London-based alternative investment management firm and predecessor to Fortrinn. He began his career as an associate at Shearman & Sterling LLP, where he operated from that firm’s New York office and subsequently its London office and advised clients on a range of capital markets matters, with a focus on high-yield debt and leveraged finance transactions. He received a B.A. in philosophy and a B.S. in business administration, with high honors, from the University of California, Berkeley and his J.D. from New York University School of Law.

Donna Rix is a Managing Director and General Counsel for Citadel Europe. Ms. Rix leads the legal and compliance function for Citadel’s asset management operations in Europe. Ms. Rix joined Citadel in 2016 from Bank of America Merrill Lynch in London, where she held various roles in the legal and compliance department, most recently as Managing Director and Head of EMEA Equities Compliance. Ms. Rix began her legal career in private practice at Wilde Sapte and then Linklaters, working in London, Paris and Tokyo. Ms. Rix graduated from University College London with a 1st Class LLB and completed her Legal Practice Course at the College of Law, London.

Moderated By:

17:00 – 17:05

Closing Remarks

17:05